Credit scoring plays a vital role in the financial sector, determining an individual’s creditworthiness and shaping lending decisions. It helps institutions evaluate risk and make informed choices, ensuring both financial stability and consumer access to credit. However, traditional credit scoring models come with limitations. They often rely on static parameters like payment history, debt levels, and credit utilization, failing to capture the complexities of modern financial behavior.

As financial markets evolve, Machine Learning (ML) emerges as a transformative force in credit scoring. Unlike traditional models, ML-based credit scoring models are capable of analyzing vast datasets, identifying intricate patterns, and adapting to changing financial landscapes. This adaptability introduces more accurate, dynamic, and fair credit assessments, providing a game-changing solution for lenders.

Machine Learning in Credit Scoring

Machine learning introduces an innovative approach to credit scoring by analyzing extensive datasets and identifying patterns that are difficult to detect using conventional methods. Rather than relying solely on past behavior, ML-based models assess various factors to predict future credit risk with greater accuracy.

ML algorithms continuously learn and improve as they process new data, allowing them to refine predictions and adapt to evolving financial conditions. This ability to "learn" makes ML an ideal tool for credit scoring, as it provides:

- Improved Accuracy and Risk Assessment: ML models analyze complex relationships between various credit factors, resulting in more precise credit risk evaluations.

- Predictive Capabilities: ML-based credit scoring can predict future financial behavior, helping lenders make forward-looking decisions.

- Handling Non-traditional Data: ML models can analyze non-traditional data sources such as social media activity, online purchase habits, or utility payments, expanding the scope of credit assessments.

- Personalized Credit Scoring: ML enables personalized risk assessments based on individual financial behavior rather than a one-size-fits-all approach.

These features make ML-based credit scoring a powerful alternative to traditional methods, offering both lenders and borrowers a more nuanced and fair assessment.

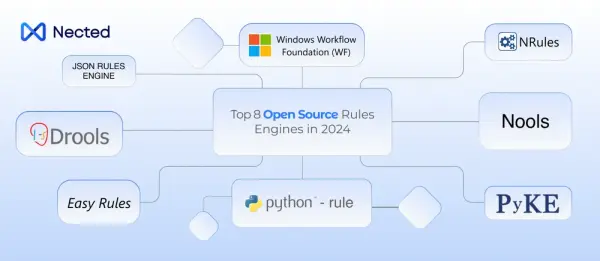

How to Implement an ML-Based Credit Scoring Model with Nected?

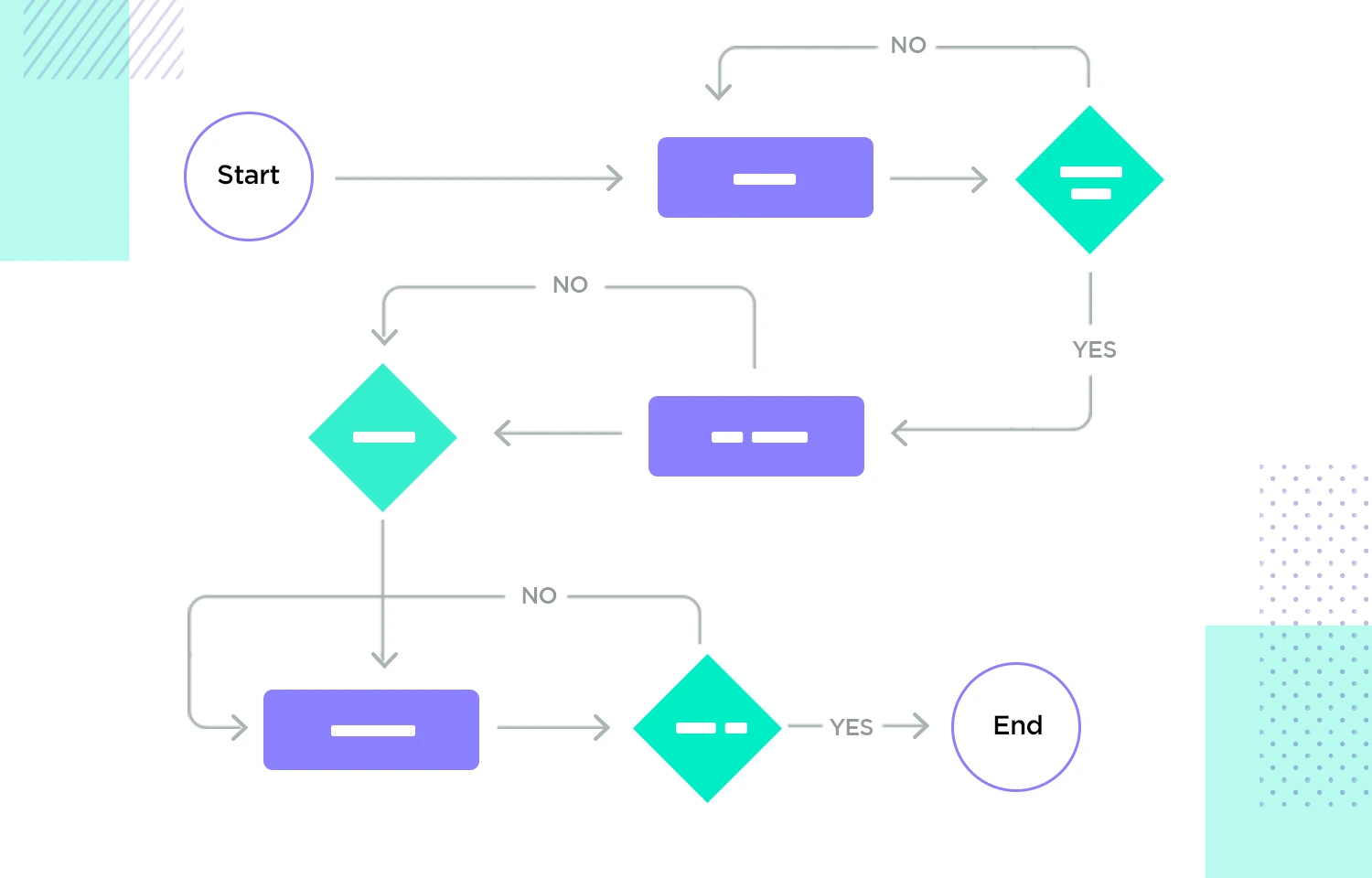

To build an ML-based credit scoring model with Nected, you can leverage its No-Code/Low-Code Rule Engine while connecting to external ML models via REST APIs or databases. Nected allows businesses to create powerful credit scoring models by integrating data from external machine learning models. Follow these steps to get started:

- Define Credit Scoring Rules: Begin by establishing traditional credit scoring rules in Nected. You can set parameters such as payment history, credit utilization, and length of credit history. These are fundamental to any credit scoring model, and Nected’s rule engine allows you to easily customize these factors without needing technical expertise.

- Integrate External ML Models via API or Database: Next, connect your external machine learning model to Nected. If the ML model is hosted on a cloud service, you can use REST APIs to fetch predictions and risk assessments. Alternatively, if your model stores outputs in a database (such as AWS Redshift, MySQL, or any supported DB), Nected can pull that data into the platform. This allows the ML predictions to feed directly into the credit scoring system, providing real-time insights for decision-making.

- Incorporate ML Predictions in Credit Scoring: Once the integration is in place, incorporate the ML predictions into your existing rules. For example, use the ML model’s risk score as an additional parameter in your credit scoring formula. This hybrid approach—combining machine learning insights with traditional credit rules—creates a more dynamic scoring system. You can adjust the weight of ML predictions in relation to traditional credit factors to optimize accuracy.

- Preprocess and Optimize Data: Before applying ML predictions in the scoring model, ensure that the incoming data is clean and ready for use. Nected provides tools for feature engineering and data preprocessing, allowing you to transform raw ML outputs into actionable insights. This step is essential to maximize the model’s accuracy and ensure that your credit scoring system operates efficiently.

- Set Up Automated Workflows for Scoring: With the rules and integrations in place, you can automate the entire credit scoring process using Nected’s workflow automation tool. Automate the flow of data from external ML models into the scoring rules, ensuring that the system processes new data continuously and generates real-time credit scores. Workflows will automatically update scores as new borrower data and ML predictions come in.

- Monitor and Adjust the Model: After deployment, continuously monitor the performance of your credit scoring model. Nected allows you to adjust rules, modify workflows, or integrate new data sources as needed. Regularly refining the model ensures that it remains accurate and aligned with current borrower behavior and financial trends. As ML models evolve or new risk factors are identified, you can quickly update the scoring process without rebuilding the entire system.

While Nected doesn’t offer built-in AI/ML capabilities, its ability to integrate with external models through APIs and databases enables you to build a robust ML-based credit scoring system. The flexibility of Nected’s rule engine allows you to combine traditional credit scoring methods with advanced machine learning predictions, creating a scalable, accurate, and efficient model.

Types of ML-Based Credit Scoring Models

Different machine learning models offer unique advantages for credit scoring. Below are a few commonly used ML models in the financial sector:

- Logistic Regression: This model is used for binary classification, such as determining whether a borrower will default on a loan. While basic, it provides a strong foundation for credit risk evaluation.

- Random Forests: Random forests combine multiple decision trees to provide more accurate predictions. It handles a variety of inputs and is highly effective for predicting credit risk by identifying complex patterns within the data.

- Gradient Boosting Machines (GBMs): GBMs are powerful tools for credit scoring. They boost the accuracy of predictions by combining weak models into a stronger one, allowing more precise credit assessments.

- Neural Networks: Neural networks simulate the way the human brain processes information and are highly effective in identifying hidden relationships between data points. These models excel at handling large datasets and are increasingly used in credit scoring.

The key advantage of these ML models is their ability to adapt to new data and evolving trends. Unlike traditional models, they continuously refine their predictions as more data becomes available, offering more accurate and reliable assessments.

Read Also: Credit Scoring: Uses, Benefits & Tool Comparison

Traditional vs. AI/ML-Based Credit Scoring Models

When it comes to credit scoring, both traditional models and AI/ML-based models offer distinct approaches. Understanding the key differences between the two can help businesses decide which model best suits their needs in today’s dynamic financial landscape. Below is a comparison table that highlights the major differences:

| Feature |

Traditional Credit Scoring Models |

AI/ML-Based Credit Scoring Models |

| Data Sources |

Limited to historical data, primarily focused on credit reports and financial transactions. |

Capable of integrating both traditional and non-traditional data sources, including social media activity, purchase behavior, and real-time financial data. |

| Risk Assessment Approach |

Static, based on predefined rules and historical data. |

Dynamic, continuously adapts to new data and patterns. |

| Predictive Capabilities |

Limited. Risk is assessed based on past behaviors and historical trends. |

High. AI/ML models use predictive analytics to forecast future credit behavior based on current and real-time data. |

| Adaptability |

Rigid, difficult to adjust to changing financial environments. |

Flexible, adapts to new data inputs, market trends, and evolving borrower behavior. |

| Accuracy |

Generally less accurate, as the assessment relies heavily on static rules and limited data points. |

More accurate, as models can analyze larger datasets and detect hidden patterns or trends. |

| Bias and Fairness |

Potential for bias due to fixed rules and reliance on historical data, which may not represent all demographics. |

AI/ML models can be trained to minimize bias and ensure fairer assessments, though they need careful monitoring for fairness and explainability. |

| Implementation Complexity |

Simpler, requires less technical expertise to set up and maintain. |

More complex to develop and maintain, often requiring expertise in data science and machine learning. |

| Model Transparency |

Highly transparent, as the decision-making process is based on clear, predefined rules. |

Can be opaque (black-box nature), making it difficult to explain how certain decisions are made, unless the model is designed for interpretability. |

| Speed of Deployment |

Faster to implement, as the rules are predefined and rarely change. |

Slower to deploy initially due to the need for model training, but once set up, updates and changes are more streamlined. |

| Scalability |

Limited scalability; struggles to handle larger, more complex datasets. |

Highly scalable, capable of processing large datasets from various sources and adjusting to increasing data volumes. |

| Cost of Implementation |

Lower upfront costs due to simplicity but may become inefficient over time with evolving credit environments. |

Higher initial costs but delivers better long-term value due to enhanced accuracy, adaptability, and efficiency. |

| Fraud Detection Capabilities |

Limited ability to detect fraud in real-time. |

Excellent for detecting fraudulent patterns using real-time analysis and anomaly detection. |

By leveraging AI/ML-based models, businesses can move beyond the limitations of traditional credit scoring, optimizing risk management, improving accuracy, and addressing new financial challenges with data-driven insights.

Challenges of Implementing ML in Credit Scoring

While machine learning presents significant benefits for credit scoring, its implementation is not without challenges. Some of the key obstacles include:

- Data Security and Privacy: Handling sensitive financial data comes with stringent security and privacy requirements. Organizations must ensure their ML models comply with regulatory standards such as GDPR or CCPA to avoid data breaches or legal consequences.

- Model Explainability and Bias: One of the main challenges with ML models is their "black box" nature, making it difficult to explain how decisions are made. Financial institutions must ensure that ML models are transparent and free from bias, especially in regulated industries.

- Access to Expertise and Resources: Developing and maintaining ML-based credit scoring models requires significant expertise and resources. Many organizations may lack the in-house skills needed to build and fine-tune these models.

Overcoming these challenges requires a thoughtful approach, ensuring that machine learning is implemented responsibly and effectively in credit scoring.

Nected: Bridging the Gap

Nected provides a solution that simplifies the integration of machine learning into credit scoring. As a No-Code/Low-Code Rule Engine, Nected allows users to create and customize credit scoring models without requiring deep technical expertise. This approach bridges the gap between advanced ML algorithms and practical, user-friendly applications for businesses.

Through Nected’s Rule Engine, businesses can create credit scoring rules that integrate with existing ML models. This allows for:

- Customizable Credit Scoring: Users can define and modify rules based on their specific needs, making credit scoring more adaptable and efficient.

- Seamless Integration: Nected’s compatibility with external data sources (such as Redshift or other databases) ensures that ML models can easily integrate into the platform, enhancing overall performance.

- Simplified Implementation: With its No-Code/Low-Code environment, Nected makes it possible for non-technical users to implement machine learning without the need for complex coding.

By offering a flexible and accessible platform, Nected empowers businesses to leverage the power of ML-based credit scoring models, improving accuracy and decision-making processes.

Read Also: Difference Between Credit Scoring and Credit Rating (Quick Guide)

Benefits of Using Nected with ML-Based Credit Scoring

By combining the capabilities of machine learning with Nected's No-Code/Low-Code Rule Engine, businesses can unlock several advantages:

- Increased Efficiency and Faster Deployment: Nected simplifies the implementation of ML models, reducing the time and resources required for deployment. This allows businesses to adopt machine learning without significant technical barriers.

- Improved Model Interpretability and Fairness: Nected’s platform helps users design models that are both accurate and explainable. This ensures that credit decisions are transparent, reducing the risk of bias and improving fairness.

- User-Friendly Interface for Non-Technical Users: Nected empowers users without technical expertise to manage and optimize their credit scoring systems. The platform’s intuitive design allows for easy integration and customization of ML models.

- Flexibility and Scalability: As your business grows, Nected’s platform can scale with it. The ability to integrate external data sources and fine-tune ML models ensures that your credit scoring system remains adaptable to future needs.

By combining the strengths of Nected and ML-based credit scoring models, businesses can create more accurate, efficient, and transparent credit scoring systems.

Read Also: Understand Credit Scoring Methods And Unlock Your Financial Success

Conclusion

Machine learning is reshaping the credit scoring landscape, offering advanced capabilities in accuracy, adaptability, and predictive power. Traditional credit scoring models, while useful, fall short of capturing the complexities of modern financial behavior. ML-based models, on the other hand, provide a more nuanced approach by analyzing large datasets and predicting future behaviors.

Nected’s No-Code/Low-Code Rule Engine acts as the perfect bridge between ML and practical credit scoring applications. By simplifying the integration of machine learning into credit scoring systems, Nected offers a comprehensive solution that improves decision-making, enhances fraud detection, and provides scalability for future growth.

As the financial sector continues to evolve, leveraging machine learning alongside platforms like Nected will be crucial for businesses seeking to remain competitive and accurate in their credit assessments.

FAQs

Q1. Can Nected directly handle machine learning (ML) models for credit scoring?

No, Nected does not offer built-in machine learning capabilities. However, it supports integration with external ML models through APIs and databases. This allows you to leverage machine learning insights for credit scoring by connecting external models and utilizing their predictions within Nected’s No-Code/Low-Code Rule Engine.

Q2. How can I integrate my ML model with Nected for credit scoring?

You can integrate your ML model with Nected by using REST APIs or database connections. If your model is cloud-hosted, you can fetch predictions via an API. If the model's data is stored in a database like AWS Redshift or MySQL, Nected can pull data directly from these sources into your credit scoring system.

Q3. What are the advantages of using Nected for ML-based credit scoring?

Nected provides a user-friendly platform that allows you to create and customize credit scoring models without requiring coding expertise. It enables seamless integration of external ML models, offering a hybrid system that combines traditional credit scoring rules with machine learning insights. This results in more accurate, flexible, and scalable credit scoring processes.

Q4. How does Nected improve data processing for credit scoring?

Nected allows for data preprocessing and feature engineering to ensure that incoming data from external ML models is clean, relevant, and optimized for decision-making. By transforming raw data before applying it to credit scoring rules, you can improve the accuracy and performance of your credit scoring model.

Q5. Can I use Nected to automate my ML-based credit scoring model?

Yes, Nected supports workflow automation, allowing you to automate the entire credit scoring process. Once integrated, Nected can automatically fetch data from your ML model, process it through the rules engine, and generate real-time credit scores, all without manual intervention.

.png)

.svg)

.webp)

.svg)

.webp)

.webp)

.webp)

.webp)

.svg)

.webp)

.svg.webp)

.webp)

%20m.webp)

.webp)

.webp)

.webp)

%20(1).webp)